Budget Deficit FAQ

What did the Close the Gap campaign this fall do?

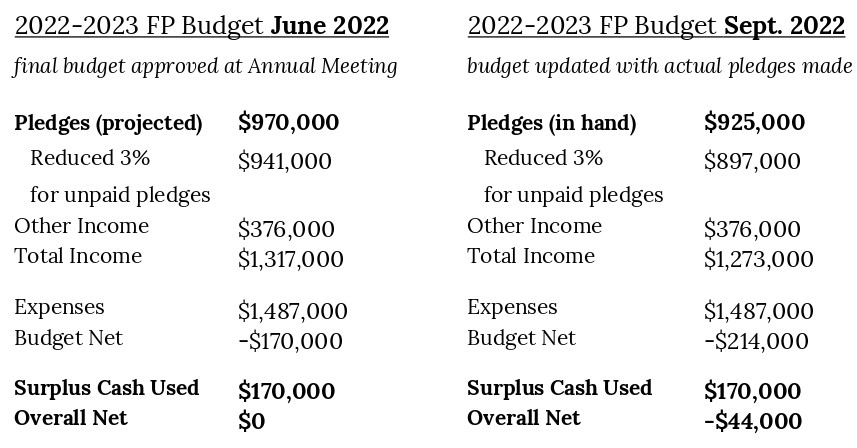

The October 2022 Close the Gap campaign closed a gap between last June’s projected pledges and the actual pledges we received by this past September. What that means: every year, when we conduct our pledge campaign, there are always stragglers, people who don’t make their pledges until after the pledge campaign has officially ended and sometimes not until after we’ve made and approved the budget for the following year. So every year we project what the actual pledge total will be based on what people have committed to so far and from past giving history. When we hold our Annual Meeting in June, the line in the proposed budget that says “Pledges” really means “Projected Pledges.” Usually our projections are pretty solid, but because of the pandemic our projection last year was off significantly more than usual.

FP = First Parish

The problem we were faced with this fall was that last spring we overestimated our projected pledge income, and our actual pledge income was $44,000 short (usually we’re off by a few thousand, not $44,000). This is why we needed the Close the Gap campaign this fall—to make up for the shortfall between our projected pledges in June compared to our actual pledges by the time September rolled around. Thank you to everyone who increased their pledge to close that gap — by December 2022 you helped us bring our actual pledges up to match our projected/budgeted pledge amount of $970,000 and prevented us from having to make cuts mid-year to this year’s budget. We so appreciate your generosity! Unfortunately, this gap that we closed between our projected pledges and our actual pledges is a separate challenge from the $170,000 deficit.

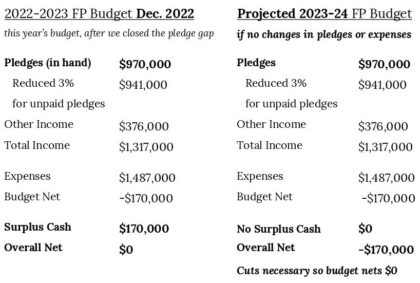

Why is there a $170,000 deficit in next year’s budget?

Last June the congregation faced a budget with expenses $170,000 higher than income due to a sharp decrease in our number of pledging households (loss of 60) during the pandemic. Instead of slashing expenses, the Governing Board recommended and the congregation voted to cover the $170,000 deficit with surplus cash. (Click here or read below to learn more about what surplus cash is.) Given that our surplus cash on hand last year was a little over $170,000, we essentially used the entire amount to cover this year’s $170,000 deficit.

FP = First Parish

This is how we already know that, if nothing changes, we have a $170,000 hole in next year’s budget — since we are spending all of our surplus cash this year to cover this year’s deficit, there isn’t any to carry over. In other words, the deficit is carrying over from this year’s budget, but the surplus cash is not.

There will, of course, be some changes to this year’s budget. Expenses will rise at least a little due to inflation. The staff, the Governing Board, committees, and ultimately the congregation will find ways to cut expenses. And hopefully our pledges will increase. Our starting point though is the $170,000 deficit that carries over from this year’s budget, without the surplus cash we had available this year to cover it.

Who are the Trustees of Parish Donations?

In contrast to the Governing Board, which is tasked with setting governance policies and managing the annual operating budget of the church, the Trustees of Parish Donations (TPD) are responsible for managing the church’s investment portfolio and properties owned by First Parish except for the main church building. The TPD is elected by the congregation to rotating five-year terms at First Parish’s annual June meeting every year. Every year the TPD disburses somewhere in the vicinity of 4% of our Legacy Investment Fund for the congregation to use in the operating budget. The exact percentage varies slightly year-to-year based on a three-year trailing average of the performance of our investments.

Why did the Trustees of Parish Donations (TPD) elect to disburse additional funds to the operating budget over the next two years?

Over the past few months, the TPD has discussed the $170,000 deficit in the 2023-24 budget at Rev. Seth’s request. At their February meeting they voted to disburse an additional $180,000 over the next two fiscal years to help the church recover from the pandemic. The rational was straightforward: during a time when First Parish is trying to recover from a once-in-a-lifetime world-wide traumatic event, it made sense to avoid the need to dramatically slash our budget since we had the resources to do so. The additional disbursement is for two years, $120,000 for the 2023-24 fiscal year and $60,000 for the 2024-25 fiscal year. This two-year increase means the $170,000 deficit will still need to be addressed – the additional money just gives the congregation a chance to rebuild with more attainable goals each year in a gradual step-down process. While cuts to programs and staff will likely still be needed over the course of the next three budget cycles even with the additional funds from the TPD, the softened blow should allow First Parish the space and extra resources it needs to successfully transition into the best version of its new post-pandemic self.

How did we lose 60 pledging households?

While our membership numbers have slowly declined over the past decade, the pandemic is the biggest factor in the loss of 60 pledging households over the past two years and the subsequent $170,000 deficit.

Membership loss is a normal part of church life even in non-pandemic years. In a typical non-pandemic year every church across denominations experiences membership turnover. Every year, some people move away, some die, and some disengage because of changes in their needs or lifestyles. Just to stay the same size, every church needs to take in some number of new members just to stay even, to replace those who have left. If you were to look at a chart reflecting a congregation’s membership over a ten-year period that appeared to hold steady, it wouldn’t reflect what’s happening “behind the scenes,” with existing members leaving and new members arriving to replace them.

During the pandemic and all-Zoom church, First Parish, like most churches, attracted few new members. So, in addition to losing folks who drifted away because of the pandemic, we also didn’t make up for members lost to “normal churn” because we didn’t bring in the usual number of new members. The pandemic thus hit us with a double-whammy of membership loss resulting in the loss of 60 pledging households in a short period.

What is “surplus cash” and how have we used it in the past?

Surplus cash is the extra cash the congregation has built up over the past many years when our income has exceeded our budget. A made-up example: if in the 2018-19 budget year the congregation budgeted income of $1,000,000 and expenses of $1,000,000, but we only ended up spending $980,000 that year because there was only one snowstorm and we had budgeted snow removal for ten snowstorms. At the end of the fiscal year the $20,000 of unspent income would be added to our surplus cash. Over time the congregation had built up a significant amount of surplus cash, supplemented by the grant we received from the government during the pandemic via the Paycheck Protection Program.

In prior years we sometimes used smaller amounts from our surplus cash, in the range of $10,000-$15,000, to bridge smaller budget deficits in an annual budget. The pandemic and sharp decrease in pledging units created the $170,000 deficit we are experiencing this year. Because we are using just about all of the surplus cash to cover our $170,000 deficit this year, our surplus cash has essentially run out, with little or no reserves available at the present moment.

Note: our surplus cash is different from our cash reserves. Our cash reserves is the 10% of our total budgeted expenses for the year that is set aside for emergencies, as required by our financial policy. Our cash reserves is not part of the available cash in our operating budget, and is held separately from our surplus cash.

You must be logged in to post a comment.